Should I Include Optional Vehicle Insurance Coverage Coverages? Each motorist has unique needs. While you do not have to include every optional kind of automobile insurance policy to your policy, the more protections you include, the much more security you'll carry the road (low-cost auto insurance). You can collaborate with our experts to obtain the best combination of protections that make feeling for you and your family members.

Full protection is much more expensive than liability-only insurance policy as it will certainly pay for repair work to your vehicle from an at-fault mishap, weather damages, burglary or various other circumstances.

It's best to compare vehicle quotes from different insurance provider utilizing your tailored elements to figure out which uses the ideal cheap complete coverage auto insurance policy. Scroll for more You can find out more concerning exactly how these complete insurance coverage prices were collected as well as calculated in Cash, Geek's approach. Contrast Vehicle Insurance Coverage Rates, Ensure you are getting the most effective price for your auto insurance.

Just How Much is Complete Insurance Coverage Automobile Insurance Coverage in Your State? Automobile insurance coverage is managed by the states, so the most inexpensive companies for full coverage at a national level might not always be the least expensive business in your state. Cash, Geek located that, the most inexpensive business for full insurance coverage across the country, is likewise more than likely to be the most affordable generally in your state - affordable auto insurance.

It was the most economical for our sample driver in 38 states. Surf to your state listed below to discover even more about the most inexpensive full coverage plans where you live.

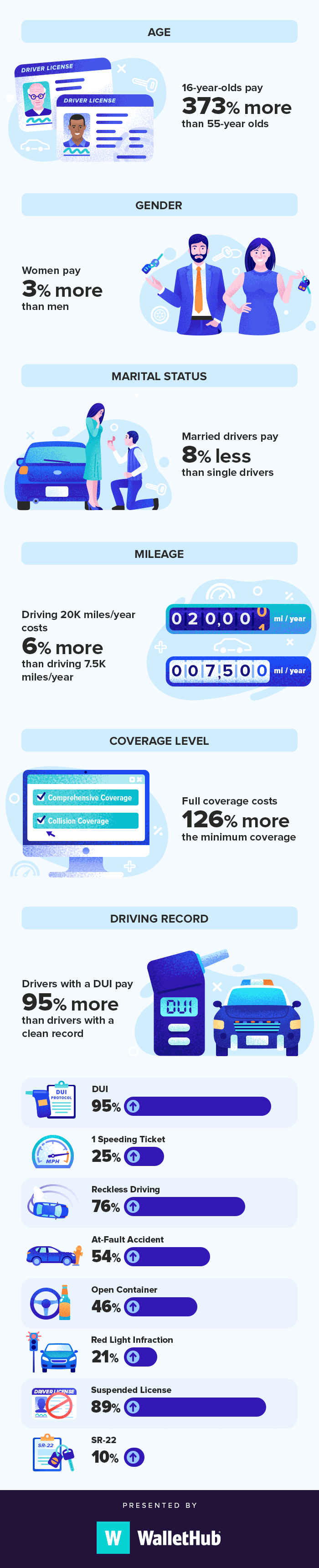

Mishaps and tickets on your driving document could raise the expense of complete coverage vehicle insurance in your state, minimizing your chances of getting low-cost vehicle insurance prices. When comparing the average annual costs for complete coverage insurance policy, the boost with a ticket is $759 each year. GEICO's typical full insurance coverage rate of $1,265 after a speeding ticket is one of the most cost effective for the majority of drivers when compared to various other firms.

What Does What Is 'Full Coverage'? - Allstate Do?

risks auto car cars

risks auto car cars

Chauffeurs with GEICO who have a background of violations can get back at extra savings with its discount rates for safety belt usage, air bags and also credit for completing a defensive driving training course. Scroll for a lot more USAA can be found in as the lowest-cost firm for these insurance coverages, costing approximately $939 per year.

If you are included in a crash, it can affect your opportunities of getting low-cost complete protection auto insurance coverage prices. laws. While not all accidents and claims will increase your rates, you need to anticipate prices to change if you are entailed in an accident. When contrasting rates for the same 50 business, we found that the average rate rise is $1,130 even more each year.

With an accident on their record, vehicle drivers guaranteed by State Ranch can expect to pay a standard of $320 even more for full protection insurance coverage than if they had a tidy driving document. Get back at much more cost savings from State Farm by making use of discounts for air bags, anti-theft gadgets or completing a defensive driving program. affordable.

How much prices alter when changing liability. Even if you're attempting to save, on your insurance bill, you must still get an ideal quantity of responsibility insurance.

The Ideal Full Coverage Automobile Insurance Provider, You need to think about even more than just rates when buying a full protection vehicle insurance plan. You'll want a business that incorporates financial savings with excellent client service as well as claims processes. And also you'll want it to be economically steady to ensure that you understand your insurance claims will certainly be paid.

Various other coverages might be consisted of completely insurance coverage automobile insurance, such as personal injury defense (PIP), medical payments, rental vehicle insurance coverage and roadside support. These extra insurance coverages are taken into consideration optional and also can be included in a quote for cost-comparison functions. How to Buy the Least Expensive Complete Coverage Policy, Among the very best means to get economical complete insurance coverage auto insurance policy is by patronizing several cars and truck insurance policy business (cheaper).

The Main Principles Of Do Teenagers Need Full Coverage Auto Insurance?

Understanding your current insurance coverages can assist you discover the best deal for full coverage. 2Quote the very same insurance coverages, Whether you're comparing two or 5 various vehicle insurer, be consistent with the protections you're making use of to contrast. Utilize the very same liability restrictions and extensive and crash deductibles to make a precise comparison to locate the very best economical complete insurance coverage cars and truck insurance coverage (credit).

Mishap mercy, void insurance policy and rental automobile protection are just a few of the alternatives available. Optional coverages vary by firm and also may not be readily available to all clients. Money, Geek has actually assessed prices throughout the board to help you locate the most effective as well as most affordable complete coverage automobile insurance in your state.

Your private circumstance and also individualized demands are the very best determining aspects of how much you'll spend for full coverage vehicle insurance (cheapest). These tips and actions can provide you a huge head start in finding your ideal choice. Common Concerns Concerning Full Insurance Coverage Car Insurance, The complying with are several of the most regular questions vehicle drivers have regarding buying complete protection automobile insurance.

It usually refers to policies that include detailed and also accident insurance coverage to the minimum obligation insurance coverage requirements mandated by your state - vehicle insurance. Comprehensive and collision insurance policy secures you versus the price of problems to your lorry, on as well as off the roadway. Obligation insurance coverage protects you against the cost of problems to others when you're at mistake.

The typical vehicle insurance policy cost for full protection in the USA is $1,150 annually, or about $97 each month. No insurance coverage can cover you as well as your automobile in every situation. Yet a 'complete coverage automobile insurance policy' plan covers you in a lot of them. Full protection insurance policy is shorthand for car insurance coverage that cover not only your obligation but damage to your automobile as well.

A complete protection plan depending upon state legislations might also cover without insurance vehicle driver coverage as well as a medical insurance coverage of personal injury defense or clinical repayments. A regular full coverage insurance plan will not cover you as well as your cars and truck in every scenario. It has exemptions to details incidents. IN THIS ARTICLEWhat is full insurance coverage automobile insurance coverage? There is no such thing as a "complete protection" insurance coverage policy; it is merely a term that refers to a collection of insurance policy coverages that not only includes liability coverage but collision and also extensive.

7 Simple Techniques For Auto Insurance - Oci.ga.gov

What is thought about complete insurance coverage insurance coverage to one chauffeur might not be the very same as even one more vehicle driver in the very same house. Ideally, full insurance coverage suggests you have insurance in the types and also quantities that are ideal for your income, properties as well as take the chance of profile.

Fees additionally differ by hundreds or perhaps hundreds of bucks from company to company. That's why we always suggest, as your initial step to saving cash, that you contrast quotes. Right here's a state-by-state comparison of the ordinary annual expense of the adhering to insurance coverage degrees: State-mandated minimal responsibility, or, bare-bones protection needed to legitimately drive an auto, Full insurance coverage obligation of $100,000 each hurt in a crash you cause, approximately $300,000 per accident, and also $100,000 for home damage you cause (100/300/100), with a $500 insurance deductible for extensive as well as collision, You'll see just how much full protection car insurance prices each month, and also annually.

cheap insurance perks trucks car insurance

cheap insurance perks trucks car insurance

dui insured car credit insure

dui insured car credit insure

The ordinary annual price for full protection with higher responsibility restrictions of 100/300/100 is around $1,150 even more than a bare minimum plan. If you pick reduced responsibility limits, such as 50/100/50, you can save yet still have respectable protection - vehicle insurance. The average month-to-month price to enhance protection from state minimum to full insurance coverage (with 100/300/100 restrictions) has to do with $97, but in some states it's much less, in others you'll pay more.

Your car, as much as its reasonable market worth, minus your insurance deductible, if you are at mistake or the various other chauffeur does not have insurance or if it is destroyed by an all-natural calamity or swiped (compensation and accident)Your injuries as well as of your passengers, if you are hit by an uninsured driver, approximately the limitations of your without insurance vehicle driver policy (without insurance motorist or UM) - insure.

In fact, complete protection vehicle insurance coverage have exclusions to specific cases. Each full cover insurance plan will have a listing of exclusions, suggesting products it will not cover. Racing or various other speed competitions, Off-road use, Usage in a car-sharing program, Catastrophes such as war or nuclear contamination, Destruction or confiscation by federal government or civil authorities, Using your vehicle for livery or distribution purposes; company use, Intentional damages, Cold, Wear as well as tear, Mechanical break down (usually an optional coverage)Tire damage, Items swiped from the car (those may be covered by your home owners or occupants plan, if you have one)A rental car while your very own is being fixed (an optional coverage)Electronics that aren't permanently connected, Customized parts and equipment (some little amount may be specified in the plan, however you can typically add a biker for higher amounts)Do I require full coverage automobile insurance coverage? You're required to have obligation insurance or some other proof of monetary responsibility in every state.

You, as an auto proprietor, are on the hook directly for any injury or residential or commercial property damage past the limitations you picked - dui. Your insurance provider won't pay greater than your restriction. Yet obligation coverage will not pay to fix or replace your auto. If you owe cash on your vehicle, your loan provider will call for that you acquire crash as well as detailed insurance coverage to secure its investment.

What Is Comprehensive Insurance And What Does It Cover? Can Be Fun For Anyone

Below are some guidelines of thumb on guaranteeing any type of auto: When the cars and truck is new as well as financed, you have to have full insurance coverage - insurance companies. (Higher deductibles aid lower your premium)When you get to a factor economically where you can change your automobile without the assistance of insurance policy, seriously think about dropping thorough and also accident.

com's on the internet cars and truck insurance coverage calculator to get our recommendation of what vehicle insurance coverage you ought to purchase. It'll likewise suggest deductible restrictions or if you need insurance coverage for without insurance vehicle driver protection, medpay/PIP, as well as umbrella insurance. Exactly how to obtain affordable full coverage automobile insurance coverage? The finest means to locate the least expensive complete insurance coverage cars and truck insurance is to shop your protection with various insurance companies.

Right here are a couple of ideas to adhere to when buying economical full protection vehicle insurance coverage: Ensure you correspond when shopping your obligation limits - car. If you pick in bodily injury obligation each, in physical injury responsibility per mishap and also in residential or commercial property damage liability per accident, always shop the very same insurance coverage levels with various other insurance providers.

auto insurance accident insurance company car insured

auto insurance accident insurance company car insured

These protections more info are component of a complete insurance coverage bundle, so a costs quote will be needed for these protections. Both accident and also detailed featured an insurance deductible, so be certain always to choose the same deductible when buying coverage - insurers. Choosing a higher insurance deductible will push your premium lower, while a reduced insurance deductible will lead to a greater costs.

There are various other insurance coverages that assist compose a complete protection bundle - insurance companies. These coverages differ however can include: Uninsured/underinsured vehicle driver protection, Personal injury protection, Rental compensation protection, Towing, Space insurance, If you require any of these added coverages, constantly choose the very same protection degrees as well as deductibles (if they use), so you are comparing apples to apples when looking for a brand-new plan.